SSPN-i, National Education Saving Fund By Government With 4% Annual Dividend For Higher Fixed Deposit Rate

National Bank cut interest rates four times in seven months, and the interest rate of fixed deposits is no longer attractive. If you are looking for investments with higher returns and lower risks, then you can consider SSPN-i.

SSPN-i is a national education savings fund launched by the government. This fund is divided into multiple groups, namely education savings accounts opened by parents for their children, and education savings accounts opened for themselves by Malaysian citizens 18 years of age or older.

SSPN-i has an advantage, that is, users can deposit money according to their financial ability. If money is tight this month, you can choose not to make a deposit for now. You can choose to deposit next month when you have a loose hand.

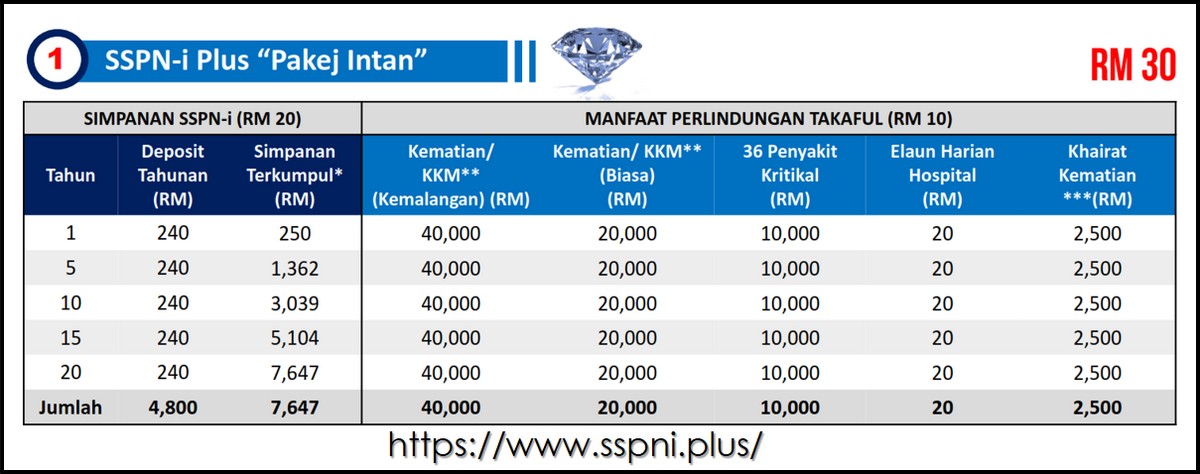

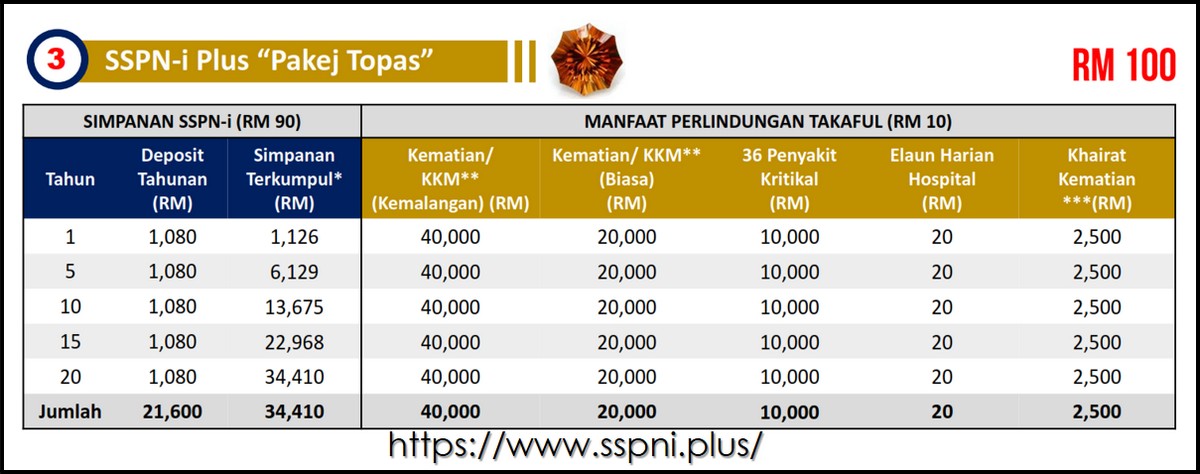

When special attention is needed, SSPN has two plans, namely SSPN-i and SSPN-I Plus. SSPN-i is a savings plan, you can deposit and withdraw freely. However, SSPN-I Plus is a plan that includes insurance and requires a monthly deposit, and part of the deposit will be used as insurance premium.

According to the records of the past 10 years, SSPN-i’s payout ratio is about 4%.