Malaysian Can Withdraw From Rm9,000 – RM60,000 From EPF Account 1 With These Guides

Based on the Metro Daily report, the Employees Provident Fund (EPF) has decided to further expand the scope of i-Sinar which involves those who lose their jobs, are given unpaid leave, or have lost their source of income.

Eligible members can apply starting December 2020. The amount will be credited in the member’s bank account at the end of the month after the application is made.

The first credit will start in January 2021. This amount will be credited periodically for up to six months starting on the first date of the credit. – The source said.

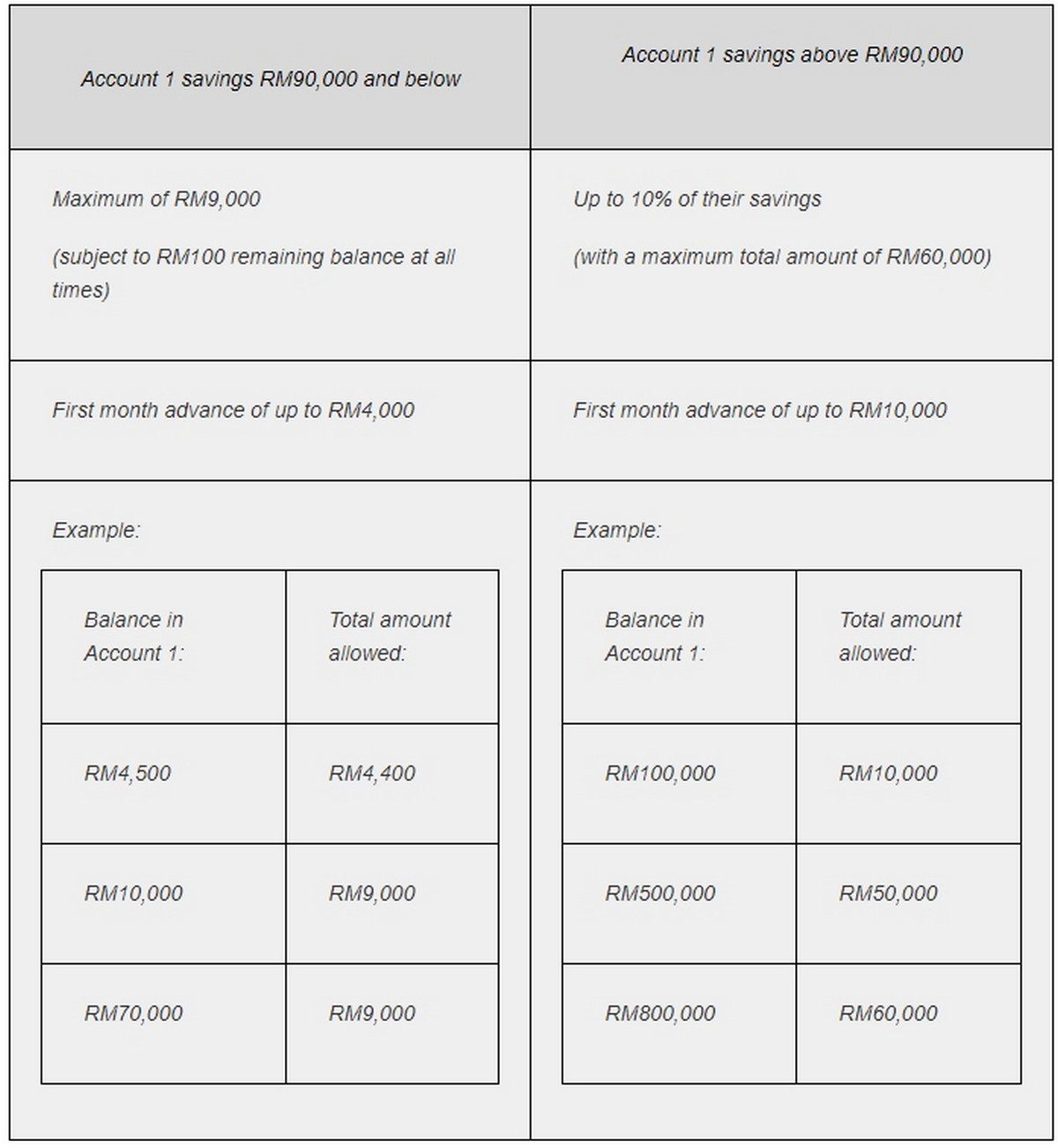

So, we can make an application and if passed we can withdraw 10 percent of the money from the remaining savings amount in Account 1. This means that if we have a balance of RM90,000 and below in Account 1, we can withdraw the amount up to a maximum of RM9,000. However, this amount will not be given on a one-off basis but will be credited periodically for up to six months with an initial advance of RM4,000. Those who have a balance above RM90,000 can withdraw up to RM60,000 maximum.

Members with a balance of more than RM90,000 in Account 1, will have access to 10 percent, but the maximum amount can be advanced is RM60,000. This advance amount will be credited periodically for up to six months with the first advance up to RM10,000. – Obviously again.

For example, once we get the work and the contribution resumed, 100 percent will be re-entered into Account 1 until the amount withdrawn is replaced. After enough, the breakdown will return to 70 percent of Account 1 and 30 percent of Account 2. In any case, for those who are planning to join i-Sinar, do the best planning or consult with a financial advisor to ensure the withdrawal is done correctly. The EPF has also expected 2 million members to have their applications approved and involve a total of RM14 billion.