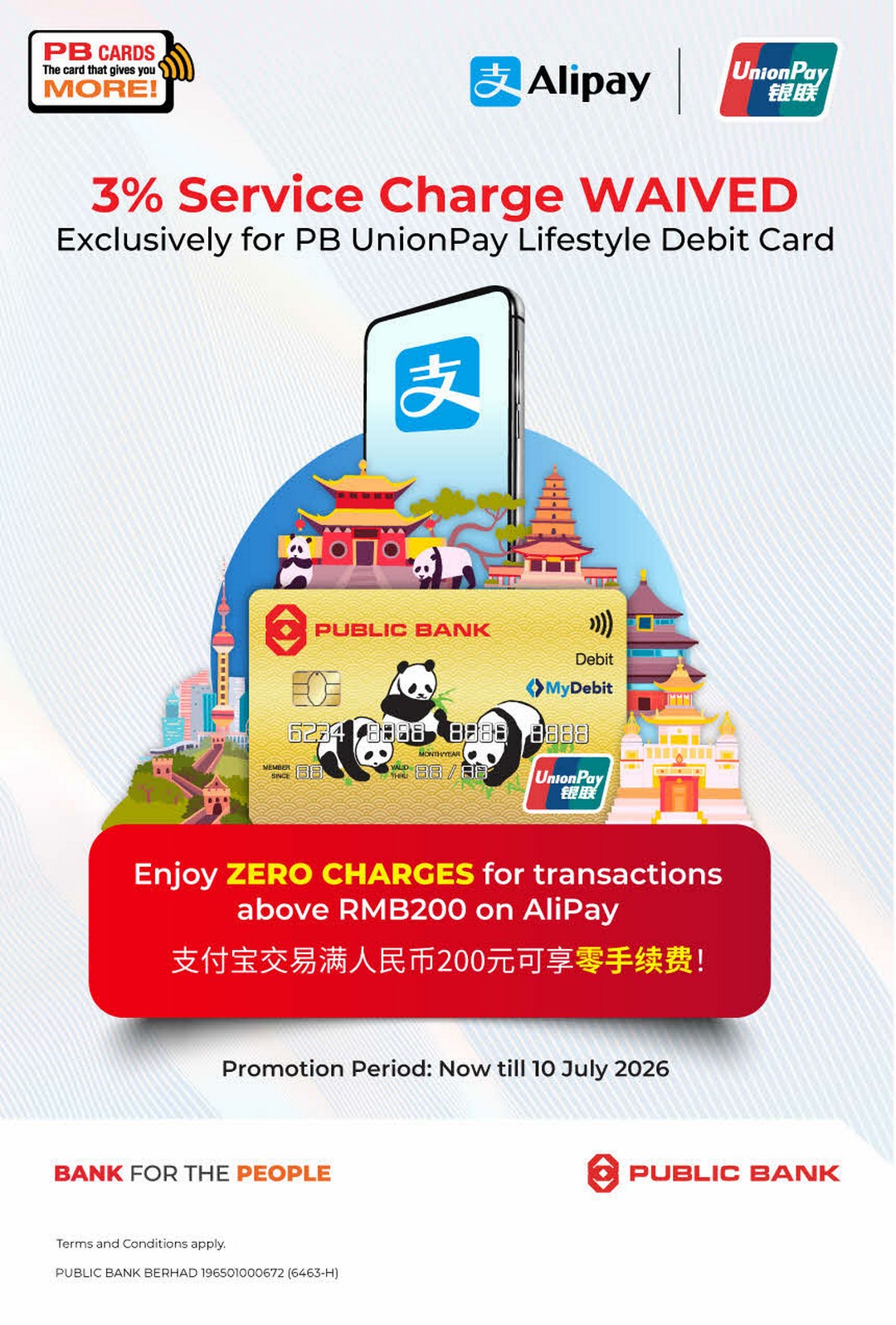

For those who regularly shop online, travel to China, or use global digital payment platforms, this promotion from Public Bank Malaysia might be the ideal deal to take advantage of right now. Public Bank is known for giving their cardholders excellent value through various card privileges, and this time, their PB UnionPay Lifestyle Debit Card holders are in for a pleasant surprise.

From now till 10 July 2026, cardholders can enjoy zero service charges when they make Alipay transactions above RMB200. In addition, the usual 3% service charge is fully waived, making this a genuinely practical offer for those who often make payments in foreign currency or travel to China where Alipay is widely used.

This campaign not only helps Malaysians save money on overseas transactions but also makes spending through Alipay more seamless and convenient. Let’s take a closer look at what makes this promotion worth grabbing, how to participate, and why it’s perfect for frequent travellers and digital shoppers alike.

A Smarter Way to Spend Internationally

Most people who’ve ever made international purchases or used payment apps abroad know that hidden service fees can easily add up. Every time you pay for something in a different currency, a small percentage goes to processing fees and conversion charges. It may not seem much at first, but those little amounts can accumulate significantly if you travel or shop online often.

That’s where Public Bank’s latest offer comes into play. By linking your PB UnionPay Lifestyle Debit Card to Alipay, you can now make payments abroad without worrying about extra costs on eligible transactions above RMB200. The 3% service charge waiver gives you the freedom to spend more efficiently, knowing that your money goes directly towards your purchase rather than unnecessary fees.

For those who love to explore, dine, or shop in China or other regions where Alipay is accepted, this is an offer that enhances your financial convenience while travelling. It’s a smart, cost-saving feature that encourages seamless global spending.

Why Linking Your PB UnionPay Lifestyle Debit Card to Alipay is a Game-Changer

Linking your PB UnionPay Lifestyle Debit Card to Alipay is more than just a matter of convenience—it’s about accessing a wider financial ecosystem that simplifies life for travellers and digital consumers. Alipay has become one of the most trusted e-wallets in Asia, widely used not only in China but also in many parts of the world for payments, bookings, and retail transactions.

For Malaysian users, the integration between Public Bank’s UnionPay Lifestyle Debit Card and Alipay bridges a gap between local banking and international spending. Instead of dealing with currency exchange hassles or carrying too much cash, you can use your debit card securely through Alipay wherever UnionPay is accepted.

And the best part? You save on every transaction above RMB200, thanks to the zero charge benefit offered under this promotion. That makes travelling lighter, safer, and far more economical.

How to Link Your PB UnionPay Lifestyle Debit Card to Alipay

If you haven’t already linked your card, Public Bank has made it easy to get started. The bank provides a step-by-step guide to help you through the process:

View the full linking guide here: https://www.pbebank.com/media/i24eaaay/alipay-wechat-pay-guide.pdf

This simple guide explains every step clearly, from logging into your Alipay account to adding your PB UnionPay Lifestyle Debit Card, verifying your information, and activating it for use. Once done, your card is ready for both online and offline payments, including stores, restaurants, and attractions that support UnionPay or Alipay QR codes.

Who Should Take Advantage of This Promotion

This promotion is perfect for:

-

Frequent travellers to China – Since Alipay is one of the most widely accepted payment platforms there, you can enjoy smoother, cashless payments without worrying about hidden fees.

-

Online shoppers – Many global merchants now accept Alipay, allowing you to shop internationally without paying extra service charges on larger transactions.

-

Business travellers and students – Whether paying for accommodation, tuition, or dining out, this waiver allows you to handle your daily expenses in a more cost-efficient way.

-

Tech-savvy spenders – Those who prefer mobile wallets and digital banking will appreciate the convenience of linking a debit card to Alipay without losing out on value.

Why You Shouldn’t Miss This Deal

Public Bank’s offer is a timely reminder that financial convenience doesn’t always have to come at a cost. This service charge waiver gives their customers a chance to maximise every Ringgit they spend, especially when converting or transacting in foreign currencies.

In today’s connected world, digital payments have become a standard part of life. From online shopping to travelling abroad, most of us use payment platforms like Alipay without even realising how much we lose in conversion and service fees. Having a deal that completely removes these charges on transactions above RMB200 can make a significant difference over time.

Moreover, the campaign runs till 10 July 2026, meaning there’s plenty of time to take advantage of this benefit. Even if you’re not travelling immediately, linking your PB UnionPay Lifestyle Debit Card to Alipay now ensures you’re ready for future trips or purchases. It’s a smart way to prepare for any overseas expenses without the last-minute rush or unexpected charges.

A Trusted Partnership: Public Bank and UnionPay

Public Bank’s collaboration with UnionPay and Alipay speaks volumes about their commitment to providing their customers with reliable and global payment solutions. Public Bank has long been recognised as one of Malaysia’s most reputable financial institutions, known for their emphasis on security, customer satisfaction, and financial innovation.

UnionPay, on the other hand, is one of the world’s largest payment networks, accepted across more than 180 countries. When you combine that with the reach of Alipay, you get a powerful trio that ensures safe, secure, and seamless payment experiences across borders.

This promotion is not just about savings; it’s about empowering Malaysians with financial tools that make global spending easier. Whether you’re exploring new destinations, managing overseas business payments, or shopping online from international platforms, this offer positions the PB UnionPay Lifestyle Debit Card as a reliable companion.

Terms and Conditions

While the promotion sounds exciting, remember that standard terms and conditions apply. It’s always good to check the details on Public Bank’s official website or refer to the PDF guide linked above to ensure that your transactions meet the eligibility criteria for the zero charge benefit.

Conclusion

If you’ve been searching for a practical way to cut down on foreign transaction fees and enjoy more value from your debit card, this is a golden opportunity. The PB UnionPay Lifestyle Debit Card promotion on Alipay offers exactly what frequent travellers and online shoppers need—a seamless, secure, and fee-free way to pay abroad.

With no extra charges on transactions above RMB200 and a 3% service charge waiver, you can now spend internationally with peace of mind. It’s the kind of offer that demonstrates Public Bank’s ongoing commitment to delivering real financial value to their customers.

So, whether you’re preparing for your next business trip, shopping spree, or holiday abroad, this is a deal worth exploring. Start linking your PB UnionPay Lifestyle Debit Card to Alipay today and make your overseas spending a lot smarter.

Promotional/Event Details:

Date: Now till 10 July 2026

Time: All day, during promotion period

Venue: Online via Alipay using PB UnionPay Lifestyle Debit Card

Guide Link: https://www.pbebank.com/media/i24eaaay/alipay-wechat-pay-guide.pdf

EverydayOnSales help brands connect with our community, the largest warehouse sales consumers database in Malaysia. Advertise with EverydayOnSales Malaysia.